#013

The Confluence

Good morning Readers.

It’s been quite an impactful weekend. Let’s sum it up in 3 minutes.

In my last newsletter, “The Pivot”, I outlined the possibility that the market reacting in a contrarian way to the last US inflation numbers was bullish.

I stated that my interest lied in revisiting the higher part of the range. $22,222 was the number.

We are crossing that level as I’m writing this weekly open edition.

As the real fight for sustained bullish momentum begins, let’s explore the crucial Confluence Zone area that lies above price.

Trend, Support and Resistance, Moving Averages

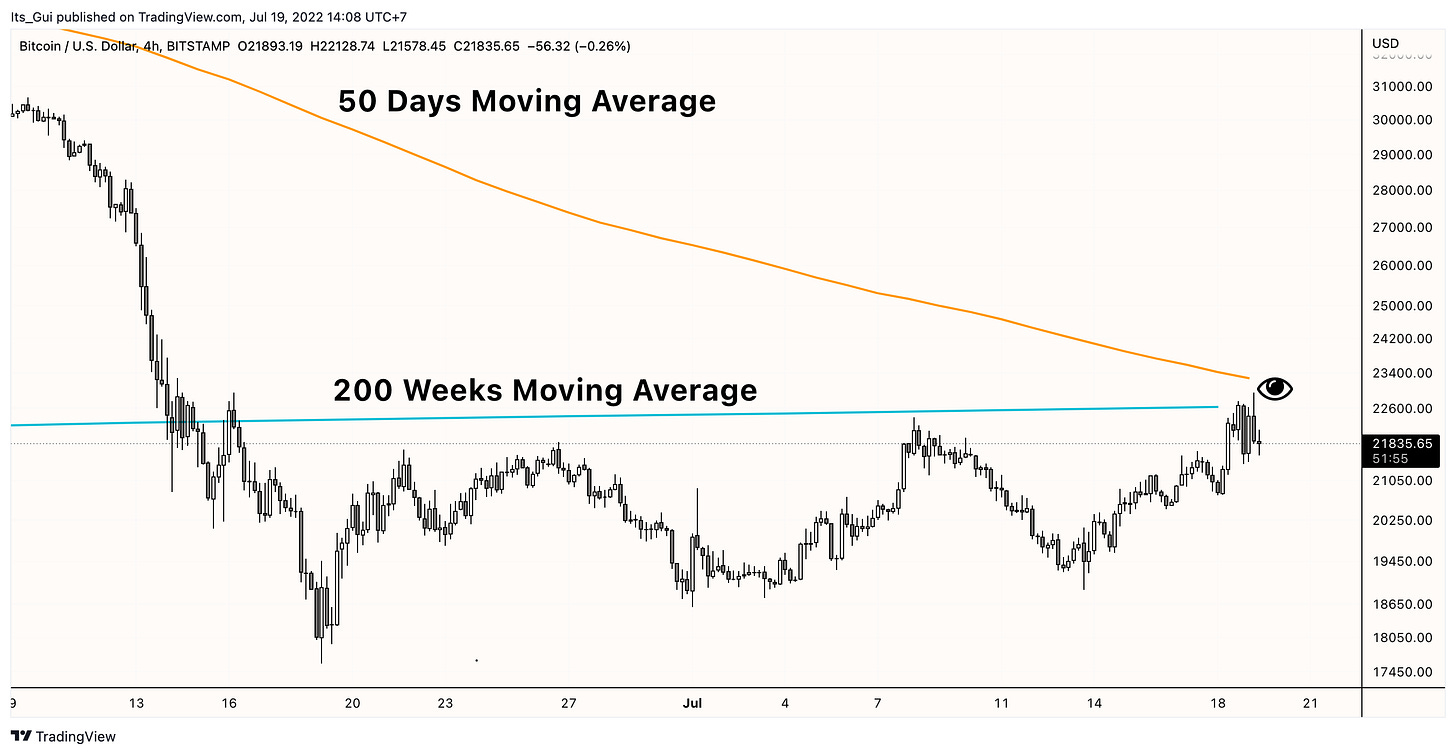

What a sight: we have the current price resistance from our month long range, the 200 Weeks Moving Average, and the 50 Days Moving Average all lined up in a 5% range.

It’s pretty obvious, if we break and sustain above this area, strong bullish sentiment will return as well as major funds and institutional players interest.

Anything under that remains really fragile near term.

Let’s be aware that fake breakouts happen - with that being said - volume and velocity of the last pushes were really, really convincing. It’s going to take a lot to tank the market back down.

Unfortunately, we’ve got a FED interest rate meeting in exactly a week. It could shatter Bullish Dreams.

The last meeting’s reaction however lets us remain hopeful that we might be closer and closer to The Pivot.

This area of confluence - and resistance - will definitely be a crucial spot. Don’t expect an easy fight.

Our Bitcoin Model will start triggering long positions again if we can break and sustain through this area, while our Ethereum Model is long since $1,275.

As the Dollar Index finally rolls over and both stocks and crypto are bouncing hard, let’s be perpetual trend followers, and flow with the market as it surges higher.

Until proven otherwise, Bulls have the hand for further continuation.

Excellent Content you shouldn’t miss:

This is not financial advice.

Please always do your own research.