#014

The Vantage Point

Hello, readers.

It’s a rare sight to have a single price level represent an importance of extravagant proportions. We are currently at this Vantage Point.

As Bullish momentum sustains, the fight for continuous near term recovery is raging.

Bitcoin finally managed to break above its institutional-grade moving averages, and is now at a crucial retest zone.

As expressed in my last newsletter, “The Confluence”, current price level holds key information for the long term health and outlook of the market.

Trend, Support and Resistance, Moving Averages

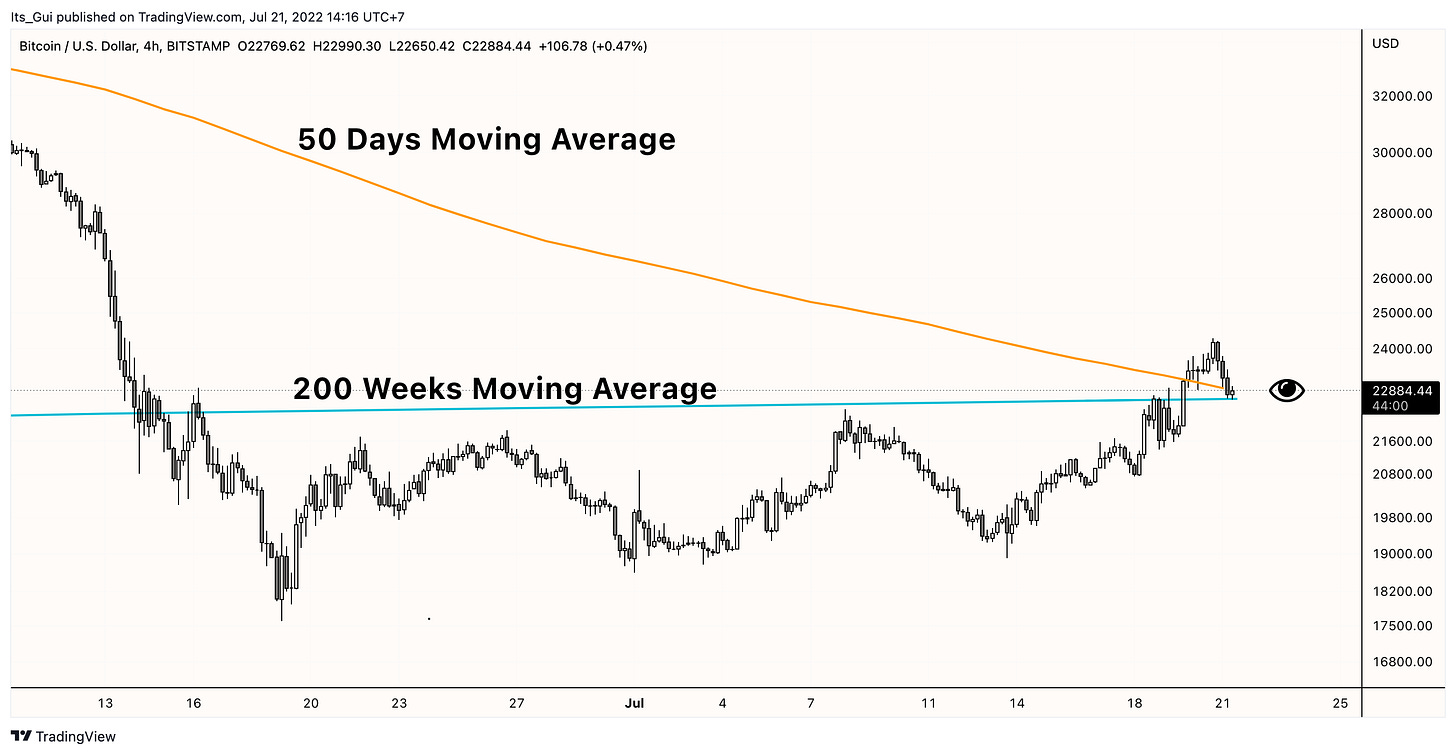

A successful break above the 200 Weeks Moving Average (Blue Line) and the 50 Days Moving Average (Orange Line) was crucial for bulls and sentiment.

It’s been 90 days that we trended below the 50 Day MA, and we’ve never - ever - trended so long under the institutional support that the 200 Weeks MA represented during Bitcoin’s history. That’s a first, and should be taken in consideration.

Price has broken upwards and is now retesting, looking for strength. Holding this confluence zone is key for short term health and confirming the support area below as a potential cycle bottom.

Let’s remember the macro tailwinds are still present and a FED interest rate meeting will be held on Monday; the ECB will also raise its rate for the first time in over a decade. This could definitely make the markets plunge, so we want to remain extra cautious.

Bulls have the hand for further continuation, but loosing this area can turn ugly really quickly. So far it’s a textbook retest of the broken range below, and traders shall look for buy opportunities in this area.

Our outlook remains Bullish - and cautious - near term.

We will be continuous buyers as long as we remain above this zone.

Excellent Content you shouldn’t miss:

This is not financial advice.

Please always do your own research.